FRANdata: Leader in Franchise Market Research, Data, and Insights

FRANdata is the franchise industry’s leading provider of market research, performance analytics, and proprietary data. For over 30 years, we’ve helped Fortune 500 companies, the largest franchisors, and top private equity firms make smarter, faster, and more profitable decisions in franchising.

Our proprietary franchise database — the largest in the industry — encompasses thousands of franchise brands (and their parent companies) and hundreds of thousands of units and their owners, providing unparalleled visibility into the franchise ecosystem. We pioneered industry-accepted performance standards such as the true franchise failure rate, unit time-to-breakeven, and the franchise continuity rate. We also created the Bank Credit Report, a trusted tool lenders use to evaluate franchise creditworthiness. The largest franchise lenders in the US rely on our FUND credit scoring system to approve and underwrite loans.

FRANdata’s research is trusted by the International Franchise Association (IFA) for its annual Franchise Economic Outlook and the IFA Annual Franchisor Survey, which tracks emerging trends, challenges, and opportunities across the franchise sector. We also power high-profile industry rankings for Franchise Update Media, including the Multi-Brand 50 and Mega 99, relied on by executives and investors to identify top-performing franchise organizations.

We work with executives who need actionable franchise intelligence to identify high-performing brands, evaluate investment opportunities, forecast market shifts, and benchmark performance. By combining decades of trend analysis with deep industry expertise, we provide strategies that help clients expand, invest, and compete successfully in the complex franchise ecosystem.

If you need franchise market research, franchise performance data, or targeted insights into the franchise landscape, there’s one trusted source: FRANdata.

Highlights

Meet our CEO

Meet the Franchise Experts

-

Edith Wiseman

As a more than 20 year veteran at FRANdata, franchising is more than a passion for Edith, the analyzing and understanding of all things franchising and equating insight into results is her calling. As president of FRANdata, Edith plays a pivotal leadership role in the strategic growth of the company's performance advisory, strategic marketing and franchise financing solutions. Due to her dedication and knowledge Wiseman is the go-to person for hundreds of franchisors, top franchise lenders, Fortune 500 companies, and industry partners. As one franchisor disruptor describes the results of her work -- “we couldn’t have grown to 1,000 stores and beyond without her and her team.” Named by Entrepreneur as a Top Influential Woman in Franchising and by 1851 as one of their Top Women in Franchising, Wiseman has long been a key figure in understanding and promoting business model excellence and franchise finance best practices.

-

Paul Wilbur

As COO of FRANdata, Paul is instrumental in building the research and consulting framework at FRANdata. Paul manages the Research, Information Management, Marketing and IT departments and plays an integral role in the strategic development of FRANdata’s suite of franchise solutions.

-

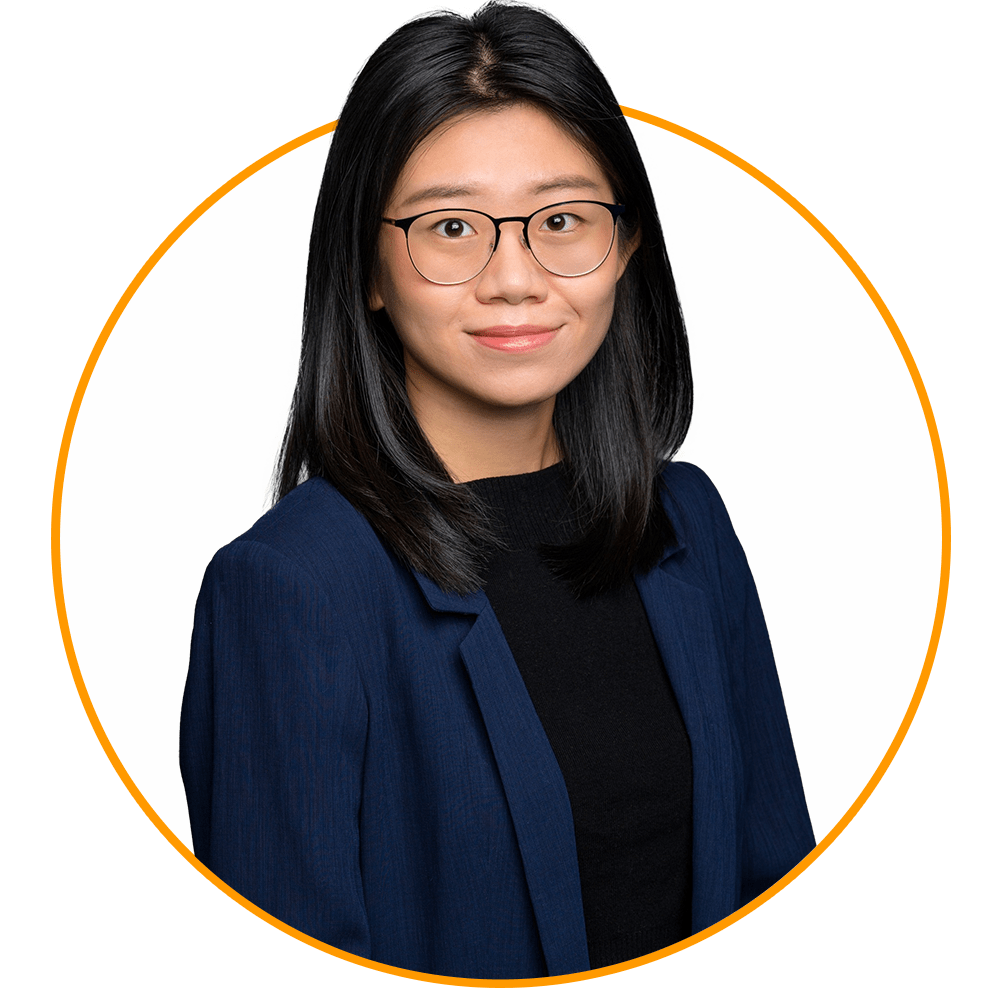

Christina Niu

Christina is the Director of Research at FRANdata, where she leads a team delivering high-impact projects in benchmarking, M&A, financial modeling, targeted marketing, policy analysis, and market sizing. With expertise built through consulting and advisory roles across retail, food & beverage, home services, and health & fitness, she produces actionable insights that drive strategic decisions. Her career includes senior consulting experience at FTI Consulting and research work at Georgetown University. Christina holds a Master’s in Applied Economics from Georgetown University and a Bachelor’s in Economics with a Minor in Mathematics from the University of Colorado Denver.

-

Alicia Miller

Alicia Miller as Managing Director at FRANdata, brings with her a powerhouse track record of advising private equity investors, PE-backed franchisors, and multi-brand platforms on investment, growth, and transformation strategies. A recognized thought leader and author of Big Money in Franchising, the first comprehensive study of private equity’s impact on the sector, she has penned 100+ articles for Franchise Times, Forbes, and Entrepreneur. Miller serves on the boards of Elevated Ventures Group, 4Ever Young, and the IFA’s Certified Franchise Executive program, and began her franchising career as a multi-unit franchisee acquisition entrepreneur—remaining an active franchise investor today. With an MBA from Wharton, an MS from the University of Maryland, a BA from Smith College, and graduate certificates from Harvard and Georgetown, she also holds CM&AA, CFE, and NACD Directorship certifications.

History

Remember the term UFOC? We started as a UFOC (now FDD) collection company, but soon customer inquiries came in asking us to compare them against their peers; so, we quickly became a data analysis company, expertly dissecting and analyzing data into understandable pieces of strategic information. It was a natural transition to go from mastering the data found in the FDD to researching beyond publicly available sources. In the mid-1990s we were proudly commissioned by the IFA to create one of the earliest attempts to analyze the franchise industry as a whole, called the “Profile of Franchising” report. Shortly thereafter, as part of our entry into franchise capital access solutions, we launched the Franchise Registry. 40,000 FDDs later and more than 10,000 franchisor and supplier clients over the years, our market has embraced our robust analysis and has helped us usher in our current role as consultants and industry analysts. With our role as objective analysts comes the responsibility to have the analytical tools in place to correctly decipher and measure a franchise business’ true performance success and failure. From the first UFOC collected over 25 years ago to the research and consulting projects of today, FRANdata has built our business from a culture of integrity and the desire to grow the industry we serve.

How it all started

-

-

1989FRANdata acquired 1,000 UFOC (Uniform Franchise Offering Circular) documents, solidifying its position as a leading source of information in the franchise industry. This marked a pivotal moment in the company’s history, enabling them to provide valuable insights to franchisees, franchisors, and investors.

-

1996FRANdata embarked on its inaugural research project in collaboration with the International Franchise Association (IFA). This marked the beginning of a fruitful partnership, further establishing FRANdata as a trusted research and data provider within the franchise community.

-

1997

FRANdata took a significant step forward by establishing the Franchise Registry. This platform became a central hub for essential franchise information, streamlining the franchise registration and lending process. It represented a milestone in enhancing transparency and efficiency in the franchising industry.

-

-

-

2001FRANdata underwent a significant change when it was acquired by NCB. This event marked a turning point in the company’s evolution.

-

-

-

2004FRANdata experienced another transition when it was acquired by Darrel Johnson. This change in ownership contributed to the company’s growth and development.

-

-

-

2009

FRANdata introduced Bank Credit Reports (BCR), expanding its range of services and becoming a valuable resource for financial information in the franchise industry.

-

-

-

2012

Began working on the Mega 99 rankings with Franchise Update MagazineRanking the largest multi-unit franchisees in the United States

-

-

-

2013

FRANdata’s impact extended internationally as the Small Business Administration (SBA) adopted the Franchise Registry Universal Numbering System (FRUNS).

Additionally, FRANdata established Franchise Business Intelligence tailored for the Australian market.

-

-

-

2014

FRANdata played a pivotal role by creating a methodology and ranking system for Forbes, further solidifying its position as a trusted source for franchise industry insights.

-

-

-

2015

Franchise Credit Score gained recognition and was used by lenders for underwriting loans, highlighting its importance in financial decision-making within the franchise sector.

-

-

-

2016

FRANdata had amassed an impressive database, collecting information from over 50,000 Franchise Disclosure Documents (FDDs). This extensive database enhanced its ability to provide valuable insights to stakeholders in the franchise

-

-

-

2018

Releases Forbes Franchises 2018More than 9000 Lender representing hundreds of banks access the Franchise Registry

Experian utilizes FUND to enhance their business scoring model

-

-

2019

FRANdata introduced the Top Score Award at the Multi-Unit Franchising Conference (MUFC), recognizing excellence within the multi-unit franchise sector. This award further solidified FRANdata’s commitment to acknowledging achievements in the industry. -

2021

Launched Franchisee Playbooks; Providing in-depth information on franchisees and their operations supercharging sales and marketing -

2023

Lenders with 5 trillion dollars in assets rely on the FUND Score to assess credit risks.