The Franchise Registry Membership

Take Control of How Lenders See Your Brand

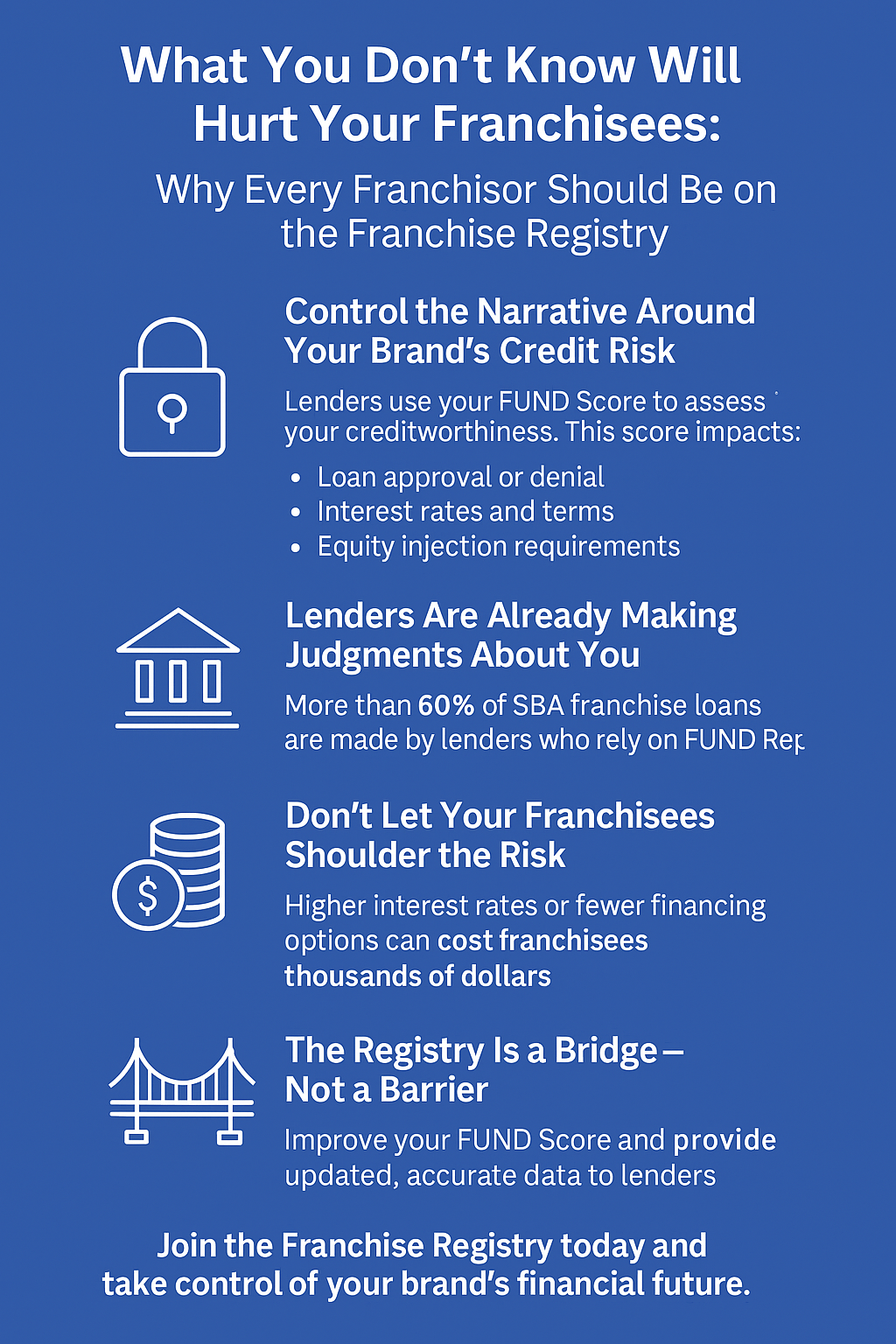

The Franchise Registry, operated by FRANdata, is used by over 9,000 lenders across the country. These lenders log in daily to access detailed information about franchise brands—not just whether they’re SBA-eligible, but whether they’re a sound credit risk.

The Franchise Registry connects your brand to the lenders that fuel franchise growth. Over 60% of SBA franchise loans come from lenders who rely on FRANdata’s FUND Score to assess risk, set terms, and make approval decisions. Without visibility into how your brand is evaluated, you’re leaving your franchisees exposed to higher costs, slower approvals, or denials.

By joining the Franchise Registry, you can:

-

Shape how lenders assess your creditworthiness

-

Reduce risk and financing costs for your franchisees

-

Access insights used in loan underwriting, portfolio management, and SBA compliance

-

Build stronger relationships across the banking ecosystem—not just with sales teams

As a franchisor, the franchise registry membership improves your franchise financing program. Being a member of the franchise registry helps you meet lender demands for efficient access to the information lenders need when they need it – this means the best outcomes for you and your franchisees.

I recently took advantage of the Financing Consultation Call offered by FRANdata. It was a real eye opener – I had no idea what I didn’t know! My advisor pointed out many opportunities for my company to a paint a more transparent, compelling snapshot of the financial soundness of our business opportunity. It is clear to me that this once call that we are not telling or great story to the lenders out there.Financing Consultation Call is no brainer and educated me on our FUND score and how meaningful the score is to lenders. I would encourage others to take advantage of it too!

Kathleen McKay

Direction of Franchise Development

Home Instead Senior Care

What Does Your Membership Mean:

- Visibility to a constantly expanding list of lender members (9,000+) who regularly seek franchise information

- Consistent, centralized, and reliable access point for lenders for signing and, if brands require other documentation, supporting lender access and fulfillment of the brand’s requirements

- A FUND Score & Report (for brands with 50+ units)

- Consultation to discuss changes in the lending environment, factors that affect your franchise system’s fundability, and what you can do to improve your FUND score and/or SBA performance data

- Host your FDDs for access by lenders 24/7

Provide access to 20 years of historical SBA documentation decisions which lenders need to process franchise loans

Peace of mind that: - Your brand’s documents will be available to thousands of lenders and are kept secure

- Your brand will always be kept abreast of the constantly changing world of franchise financing regulations and lending guidelines

SBA Franchise Certification: Navigating sweeping SBA changes can be complex — but you don’t have to do it alone.

FRANdata works directly with SBA officials and lenders to guide franchisors through:

• Submitting SBA Certification on behalf of our members

• Pre-submission vetting of your FDD and business model

• Certification form preparation

• Risk mitigation strategies if eligibility concerns arise

Franchise Registry Membership Positions Your Brand for Growth by Navigating Every SBA Policy Shift with Confidence.