Franchise financing outcomes vary widely across systems, but new evidence shows that brand-level creditworthiness plays a measurable role. FRANdata analyzed more than 18,000 SBA 7(a) loans issued to franchisees from 2010 to the present—representing roughly $8 billion in total financing—to quantify how FUND Scores relate to loan performance.

The findings confirm a statistically significant relationship between a franchise system’s FUND Score and both interest rates and default risk, offering franchisors and lenders a data-driven lens for assessing credit quality.

What the FUND Score Measures

The FUND Score (Franchise Credit Score) is FRANdata’s proprietary system for evaluating the creditworthiness of franchise brands from a lender’s perspective. It assigns each brand a score on a 0–950 scale, using a model that incorporates more than a decade of data across 13 credit risk categories—from franchisee performance and system growth to transparency and financial reporting.

In essence, the FUND Score functions as a standardized credit rating for franchise systems, helping lenders compare risk across brands and giving franchisors a clear benchmark for how their system is viewed by the credit community. (Learn more about the FUND Score)

Quantifying the Relationship Between FUND Scores and Loan Terms

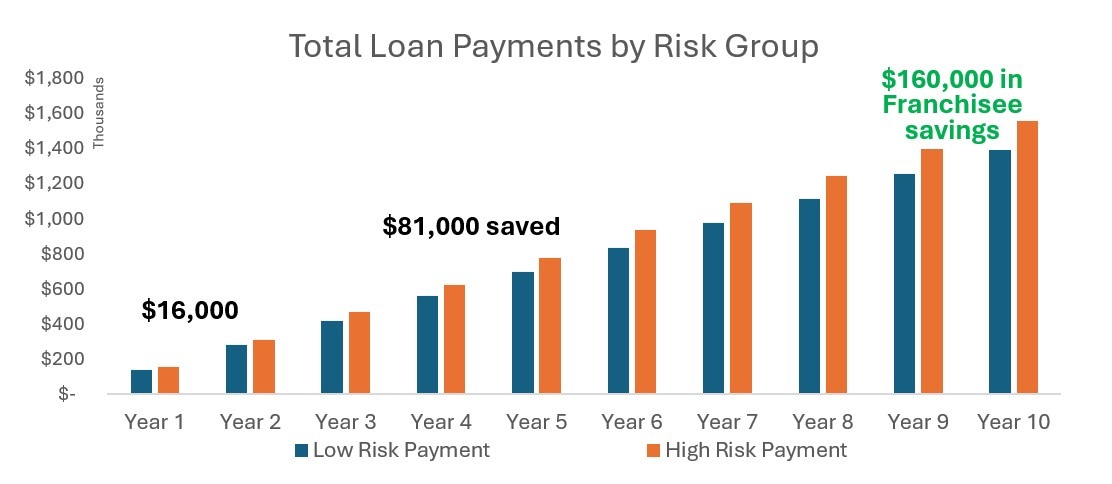

When SBA 7(a) loans are grouped by FUND Score risk category, a clear gradient emerges.

When SBA 7(a) loans are grouped by FUND Score risk category, a clear gradient emerges.

-

Franchisees associated with Minimal Risk brands (FUND Scores above 800) pay meaningfully lower interest rates than those linked to High Risk brands (below 400).

-

Using a 9% rate as a benchmark for high risk, the model indicates a rate near 6.6% for minimal risk—a difference that translates to approximately $162,000 in interest savings over the life of a 10-year, $1 million loan.

This result demonstrates that franchise system stability, transparency, and performance—factors embedded in the FUND Score methodology—are directly reflected in loan pricing outcomes.

Portfolio Effects for Lenders

Lenders incorporating FUND Scores into their underwriting see measurable improvements in loan performance. Across participating institutions, average charge-off rates declined from 6.94% to 5.68% after adoption—a roughly 20% improvement in portfolio outcomes.

These findings suggest that standardized franchise-level credit assessment supports more precise risk segmentation and more efficient capital allocation within SBA portfolios.

Implications for Franchisors

A higher FUND Score signals operational strength and financial transparency—qualities that directly influence lender confidence and franchisee access to capital.

For franchisors, maintaining or improving a strong FUND Score can:

-

Enhance brand attractiveness to lenders.

-

Support lower financing costs for franchisees.

-

Provide benchmarking insight into the variables driving perceived credit risk.

In a lending environment with heightened scrutiny, objective data on franchise creditworthiness is becoming essential to sustaining system growth.

Conclusion

FRANdata’s research confirms that higher FUND Scores correlate with lower borrowing costs and improved loan outcomes. For franchisors, the implications are strategic: creditworthiness is measurable—and manageable.

Brands that invest in the factors driving stronger FUND Scores position themselves, and their franchisees, for more predictable access to capital and more sustainable long-term growth.

Download the Complete Report HERE