How Leading Franchise Lenders Use FUND Scores to Improve Franchise Loan Performance

In a lending environment defined by tightening credit standards and rising risk awareness, franchise lenders are increasingly turning to data-driven franchise lending insights to improve decision quality and portfolio outcomes. FRANdata’s latest analysis of more than 18,000 SBA 7(a) loans shows how measurable credit indicators—like the FUND Score—help banks quantify franchise system risk, reduce charge-offs, and identify stronger lending opportunities.

FUND Scores Help Lenders Quantify Franchise Risk

Every franchise system carries its own performance characteristics. The FUND Score converts those variables—like historical unit success, system growth, and financial stability—into a standardized, data-backed measure of credit risk. In this study, higher FUND Scores consistently aligned with lower charge-off rates and reduced interest rates, demonstrating how the metric helps lenders price and manage franchise risk with greater precision.

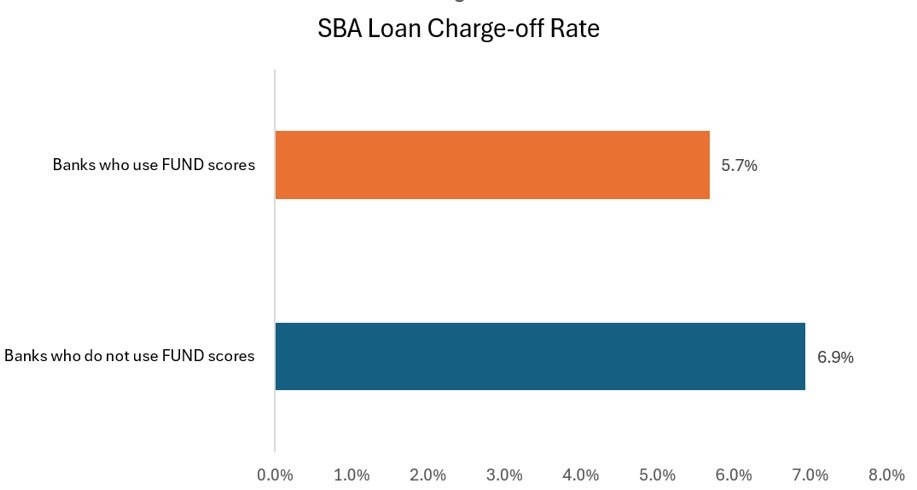

Clear Impact on Portfolio Health

Lenders that integrated FUND Scores into their underwriting achieved an average 20% reduction in charge-offs. Among the loans analyzed:

- High-Risk brands (FUND < 400) had roughly 15% charge-off rates.

- Minimal-Risk brands (FUND > 800) saw charge-offs below 2%.

Those differences translate directly into stronger, more predictable loan portfolios—especially when lenders use FUND Scores to guide eligibility, pricing, and exposure limits.

Tangible Savings for Borrowers

The analysis also found that higher FUND Scores corresponded with lower interest rates. On a $1 million, 10-year loan, borrowers working with Minimal-Risk brands could save approximately $160,000 in interest compared to those in High-Risk systems. Those savings reinforce why credit risk differentiation matters—not only for lenders’ margins but also for the long-term health of franchise borrowers.

A Data-Driven Foundation for Franchise Lending

For lenders, the takeaway is straightforward: franchise system performance can be quantified, benchmarked, and integrated into your underwriting models. The FUND Score provides a statistically validated framework that enhances both credit decisions and portfolio management.

Learn more about how FRANdata supports lenders at frandata.com/lending-institutions.

Download the report — Correlation between FRANdata FUND Scores and SBA Loan Performance Lender