FRANdata has continued to test and review the FUND Model to ensure it provides the best possible measure of franchisor risk available to lending institutions. Applying this model to more than 500 brands, the predictable pattern between loan performance and FUND credit scores continues, while being fine-tuned for 2020.

FRANdata has continued to back-test the scoring model with brand-level unit and loan performance, which remains correlated to loan performance. Franchise loan performance

over time is influenced by the interplay of customer preferences, borrower management ability, and franchisor/franchise system performance. Lenders are proficient at assessing the risk implications of customer trends and borrower management. With the FUND score, lenders are able to differentiate loan performance expectations based on the implied credit risk of the associated franchise brands. FUND categories and FUND Scores show the credit risk position of each franchise system relative to all other franchise systems and help inform a lender’s loan performance expectations.

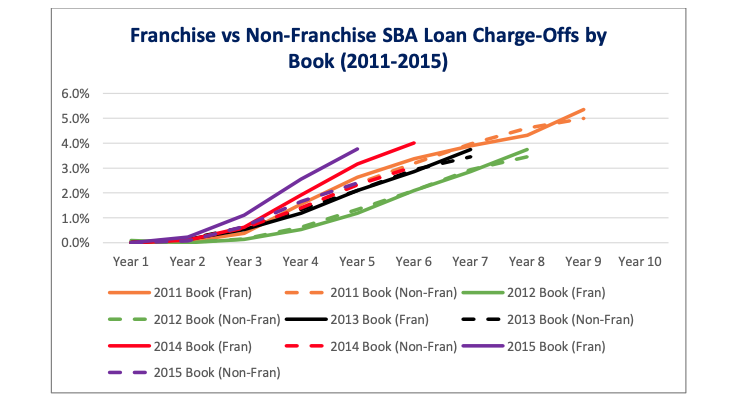

For the purpose of this analysis, FRANdata examined seasoned loans (SBA backed loans booked between 2011 to 2015) to determine the predicted loan success rate by a brand’s FUND score. The charge-off rate for franchise loans originated in 2011, 2012, and 2013 track with the rest of SBA’s non- franchise loan portfolio. The 2014 and 2015 books have underperformed the non-franchise portfolios.

As of the end of Q3 2019, the 2014 franchise book charge-off rate is nearly a full percentage point higher than the non-franchise rate, 4.01% to 3.06% respectively. The 2015 franchise book, with five years of seasoning, has a charge-off rate of 3.8%, as compared to 2.4% for non-franchise loans. Both these books are also experiencing a higher percentage of charge-offs than the 2011 to 2013 books at the same maturity year.

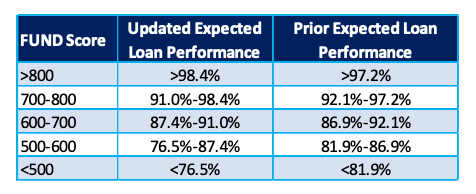

Based on this analysis, FRANdata has recalibrated loan performance expectations based on the new data:

The FUND score is predictive of loan performance with a .61 correlation between the two values. The >.5 correlation highlights the predictive value of the FUND score. As we enter a period with increasing charge-offs and more economic instability, understanding the risk the franchisor presents to franchisees is of growing importance in accurately assessing the riskiness of a potential borrower.