Lenders Counter with Technology Solutions

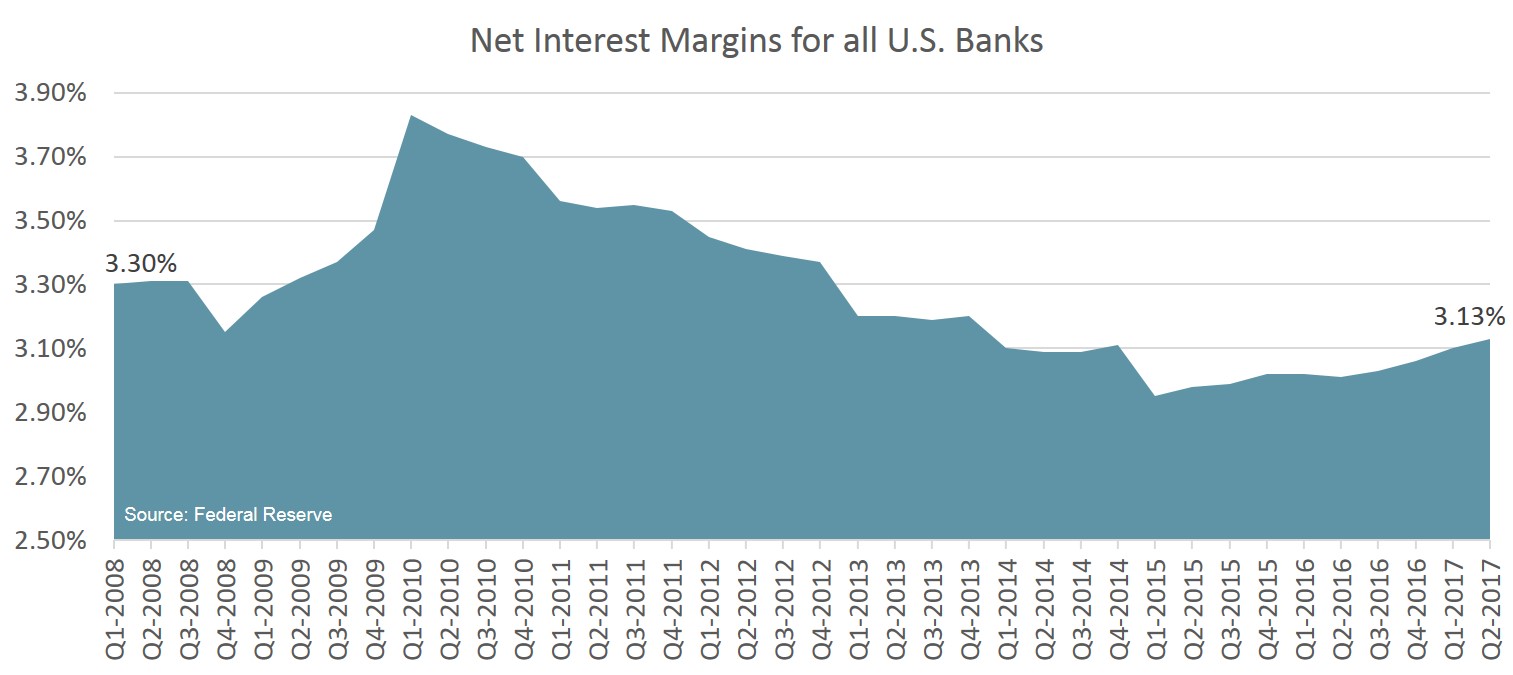

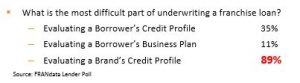

The historically flat yield curve and rising internal costs are reducing small business lending profitability, pushing lenders into a classic capital for labor shift – relying more on technology to evaluate brands and borrowers. In a poll of more than 150 Lenders– 89% found that evaluating the franchise brand’s credit profile the most difficult part of underwriting. To lower the cost while increasing the quality of underwriting franchise loans, all kinds of capital providers – SBA, conventional, alternative, leasing and more – are using tools like FUND Scores and Bank Credit Reports for brands and FICO Scores for borrowers.

This lending shift is dramatic. In 2017 lenders that financed over $3 billion to small businesses incorporated FRANdata’s FUND Scoring Model directly into their credit assessment. The credit score provides a more accurate as well as cost effective solution to evaluate franchise brand creditworthiness and dramatically lessens the possibility of in-house credit assessment inaccuracies. In addition, the FUND score was found to be a better predictor of future loan performance.

This lending shift is dramatic. In 2017 lenders that financed over $3 billion to small businesses incorporated FRANdata’s FUND Scoring Model directly into their credit assessment. The credit score provides a more accurate as well as cost effective solution to evaluate franchise brand creditworthiness and dramatically lessens the possibility of in-house credit assessment inaccuracies. In addition, the FUND score was found to be a better predictor of future loan performance.

Banks have also found that with franchise lending they can improve business development efficiencies by using brand screening and access tools such as those found on the Franchise Registry. The constantly fluctuating state of the lending market makes it vital that franchisors stay up-to-date with the pulse of lender needs and qualifications.