One of the most asked question from lenders on the FUND Score/Report, has got to be “Its great when my borrower is investing in a brand with a high franchise credit (FUND) score, and there are many, but what does it mean to the loan or my lending process when the franchise is scored low?” […]

In my more than 15 years of Commercial/SBA lending experience, I have gained some valuable insights in helping others to start and expand their businesses as a lender. They relate well back to some very wise sayings I have heard throughout my life. The 5 things new borrowers need to know will be structured around […]

Mergers and acquisitions within franchisees have become more of a commonplace over the past three years as resale activity gain traction in franchising; take, for instance, the levels of transfer activity in franchise systems. These have increased from slightly over 3% to almost 5% between 2014 and 2017, according FRANdata’s internal database. From the looks […]

Consider this: 39% of units for the largest 200 restaurant franchisors in the U.S. are now international and over the past three years, 74% of these franchisor’s collective unit growth came from outside of the U.S. [1] The U.S. Department of Commerce estimates that over 75% of the expected growth in the world’s trade for […]

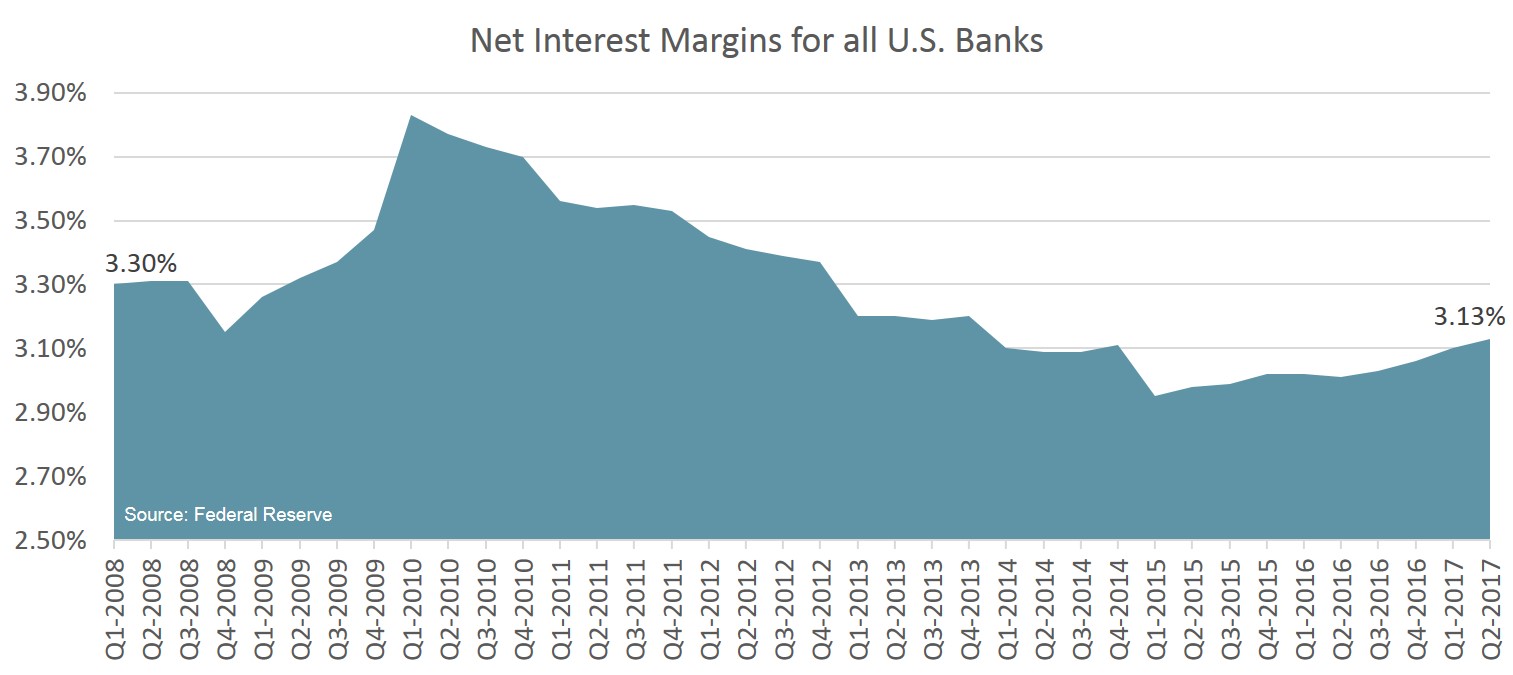

Lenders Counter with Technology Solutions The historically flat yield curve and rising internal costs are reducing small business lending profitability, pushing lenders into a classic capital for labor shift – relying more on technology to evaluate brands and borrowers. In a poll of more than 150 Lenders– 89% found that evaluating the franchise brand’s credit profile […]