The Small Business Administration (SBA) has recently announced significant changes to how it deals with franchise lending, signaling its departure from the messiness of franchise oversight and eligibility. These changes aim to simplify and expand the program, aligning it with the success of the Paycheck Protection Program (PPP) that provided loans to small businesses during challenging times. However, these changes have sparked concerns and dissent among lenders and Congress, prompting further scrutiny. In this blog post, we will delve into the reasons behind SBA’s decision, the implications of the new rules, and how franchisors and franchisees can navigate the evolving landscape of SBA financing.

The Objective: Simplify and Expand the SBA Loans Program

The overarching objective of the new rules is to simplify and expand the SBA loan program. The success of the PPP demonstrated the potential for injecting more capital into small businesses and attracting a wider range of lenders. Before the PPP, many franchise businesses faced barriers to accessing SBA loan programs, and numerous banks chose not to participate. The unprecedented amount of funding provided by the SBA during the PPP highlighted the opportunity to bring more banks into the program and provide more significant support to small businesses.

Understanding the Changes: Eliminating Regulation and Enhancing SBA Financing Flexibility

The new rules eliminate extensive franchise affiliation regulations, reducing nine pages of bureaucratic hurdles. This streamlining process allows for greater flexibility and removes unnecessary burdens for franchisors and lenders alike. Additionally, the rules eliminate the tracking of franchise loan performance, reducing the potential for negative media coverage. While this is positive for the franchise industry, lenders still require reliable performance data to assess risk effectively. As a result, lenders may need to seek alternative sources for performance data such as the FUND Score.

Shifting Responsibility: Franchise Eligibility and Lending Criteria

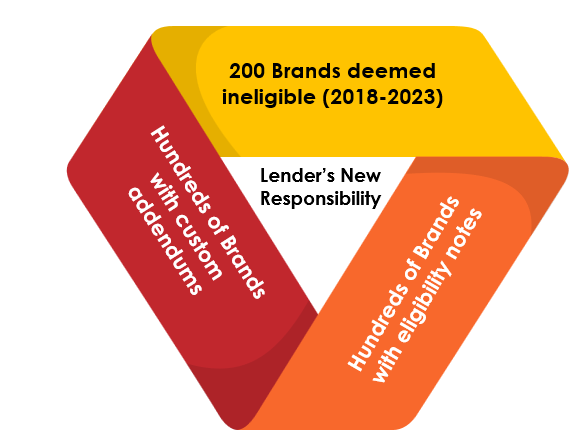

Another notable change is removing the franchise directory, shifting the responsibility of determining franchise eligibility and lending criteria to lenders. The SBA believes that franchise eligibility assessment should fall within the purview of lenders, who historically have not reviewed franchise documents for eligibility. However, this change also means lenders will no longer receive guidance from the SBA on lending criteria, creating a potential bottleneck as lenders figure out the best way to backfill what was previously an SBA responsibility.

criteria to lenders. The SBA believes that franchise eligibility assessment should fall within the purview of lenders, who historically have not reviewed franchise documents for eligibility. However, this change also means lenders will no longer receive guidance from the SBA on lending criteria, creating a potential bottleneck as lenders figure out the best way to backfill what was previously an SBA responsibility.

Opening Doors for Fintech: Expanding Opportunities

The second rule potentially opens up the SBA loan program to fintech companies. Previously, there was a moratorium on non-federally regulated institutions offering SBA loans. With this new rule, countless fintechs could enter the program, aligning with the objective of program expansion. While this seems promising, concerns have arisen regarding potential aggressive lending practices and a potential decline in loan quality, which could jeopardize the overall program.

Navigating the Changing Landscape: Implications and Strategies

Lenders are calling it the Wild West. Since the liability is shifting to the lenders, there will be different standards, processes and forms that individual lending institutions will implement. Franchisors and franchisees should anticipate being treated differently by various lenders due to the changes in rules and regulations. Some lenders may request a certificate of no change or a non-material change, while others may continue to ask for franchise addendums. Lenders can hire outside counsel, utilize SBA general processing, or rely on brand data services to ensure eligibility and credit assessments. Open communication and transparency between lenders and franchisors will build trust and facilitate a smoother lending process.

Essential Action Items for Franchisors

- If you haven’t yet, Find out your FUND Score. Lenders will increasingly rely on FUND™ scores to assess risk without SBA performance data.

- Send us your addendum – Franchisors with customized addendums should engage with FRANdata representatives to ensure the removal of affiliation language and provide the necessary eligibility documentation that lenders are looking for.

- Stay tuned for customized certificates! A proprietary customized certificate can address lender concerns and provide a standardized approach for eligibility verification.

Overall, change can be daunting, but it also presents opportunities for growth. Remember to contact a FRANdata Capital Access Advisor if you have any questions (franchiseregistry@frandata.com )